Capital market risk is in a heightened state these days. Equity indices are near all-time highs. Interest rates have moved sharply higher in a relatively short period. The economy appears poised for continued expansion on the wings of potentially stimulative fiscal policies from a new administration.

Capital market risk is in a heightened state these days. Equity indices are near all-time highs. Interest rates have moved sharply higher in a relatively short period. The economy appears poised for continued expansion on the wings of potentially stimulative fiscal policies from a new administration. When so much ‘good news’ dominates the headlines, we find it a valuable exercise for our insurance clients to take a step back and re-visit the risks inherent across their enterprise.

Captive insurers traditionally make money from their investment portfolio and in some cases from their insurance operations. Each of these parts of an insurer’s business involves different, but quantifiable, risks.

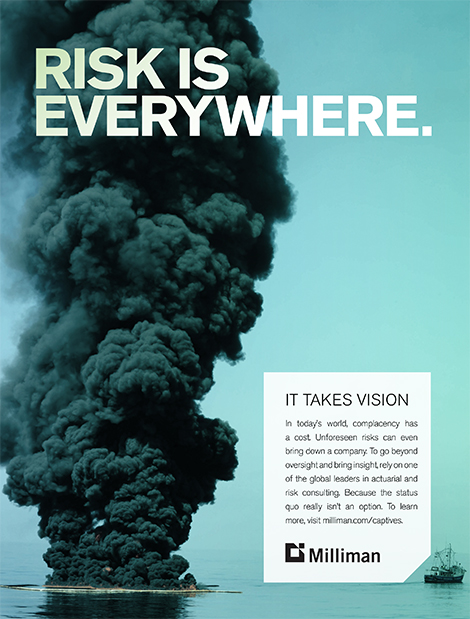

The risks of captive insurer’s operations tend to be narrower and less diversified than those of typical multi-line insurers. This can be a double-edged sword: the narrower scope of insured risk is more easily defined, but the lack of diversity makes the insurance operation more susceptible to unforeseen, black swan events, which are difficult to absorb.

For many years, the investment side of the enterprise was where captives made their money. The multi-decade bull market in bonds and a near-tripling of stock market values since 2009 lows have provided reliable tailwinds for investment portfolio profitability. This has helped captives weather, and prosper, during periods of uneven underwriting results.

In the last few years, however, as interest rates fell to historic lows and stock market performance became increasingly volatile, profits from the investment portfolio have become more uneven and captives have had to increasingly rely on underwriting results to sustain their operations and build surplus. Indeed, according to A.M. Best, US captive net investment income has been flat-to-down over the last five years while net underwriting income has continued to grow.

Today’s low yields, tight credit spreads and full equity valuations reflect a capital market environment exposed to a heightened level of risk. This backdrop demands that captives pay attention not just to the operational side of their risk budget, but also to the risk budget as it relates to their investment portfolio. Does the investment portfolio adequately balance and reflect the risks on the underwriting side? Are they outsized or over-exposed in any particular area? How have operational risks changed and how should the investment portfolio be re-positioned to be more responsive to operational risks? And, most importantly in today’s environment, has the capital market environment itself shifted in a way that places the asset side of the balance sheet at greater risk?

Headlines recently highlighted the Dow Jones industrial average breaking the 20,000 level. Other market indices have consistently set new highs over the last several months. Yet, despite this good news, many of the forward-looking stock market indicators on which we focus are flashing caution. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), has settled down after several brief periods of heightened uncertainty in the past year. The current low level of the VIX can be interpreted as an indicator of investor complacency, which is often a pre-cursor of volatile periods ahead.

Similarly, there’s been a big shift recently in money flows by individual investors. For the better part of the last few years, individual investors have been pouring money into bond funds even as interest rates fell to historic lows. Recently, as interest rates began to rise last fall, investor preferences have shifted away from bonds and back toward stocks. Historically, leaning in the opposite direction of individual investor money flows has been rewarding.

Stock market valuations are currently somewhat stretched and reliant on future growth in earnings, which may be difficult to achieve in an environment of a strong US dollar and ongoing weakness in overseas economies. While we wouldn’t be surprised to see equities continue to move grudgingly higher for a little while yet, the risk/reward equation at current levels is at best symmetrical and, more likely, skewed toward more risk and less reward.

Interest rates have begun to move higher as the economy has firmed and Federal Reserve policy has adopted a more hawkish tone. Indeed, in December of last year the Fed raised the federal funds rate by a 0.25 percent. The Fed and the markets seem to be in sync in their expectation for more increases in short-term interest rates in 2017. In response, longer-term interest rates have moved decidedly higher from the generationally low levels seen in the summer of 2016.

In an historical context, the approximate 100-basis point jump in long-term yields seems small, but it’s nonetheless been painful as there is little income yield in the equation to offset the decline in market prices experienced on high-quality bonds. The mathematics of bonds and bond duration highlight this point, as more of a bond’s total return these days comes from price change rather than income yield. Credit spreads, the premium received by investors for purchasing riskier bonds, have consistently shrunk in sympathy with an advancing stock market and sustained growth in profits. Yet much of the gain in corporate profits has come from balance sheet management as companies buy back their own stock using low-cost debt, leading to an overall increase in balance sheet leverage in the private sector.

And finally, political risks have risen. The change of administration in the US, and rising protectionist sentiments globally, has fostered a backdrop of heightened geopolitical risk, which could upset currency markets and trading relationships. While the new US administration’s proposed fiscal policies, at face value, have a pro-growth undertone, they come at a time in the US economic cycle when the unemployment rate is low, inflation is rising, and incomes are advancing at the strongest rate since the end of the ‘great recession’. While not currently in problem territory, inflationary pressures are building and bear watching.

Madison Scottsdale is an active manager of our clients’ insurance assets, but the term ‘active’ doesn’t mean that we’re jumping into and out of asset classes to capture market moves. Rather, the ‘active’ in our approach is designed to respond to our clients’ overall risk budget. When risks rise on the operational side, captives should seek to temper the risk in their investment portfolio to ensure that it is operating within its risk budget.

Conversely, when operating results are expected to be strong, it’s often advantageous to tweak the risk in the investment portfolio if the available rewards justify. In today’s environment of heightened capital market risk, we believe that captives need to pay close attention to the quality of their investment portfolio to protect the asset side of their balance sheet.

Taken together, full equity valuations, rising interest rates, paltry risk premiums and rising geo-political uncertainty paint a challenging backdrop in which to invest and lead us to pose the question: what’s in your risk budget?

Bonds are subject to certain risks including interest rate risk, credit risk, call risk, risk of default, liquidity risk and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds.

Although the information in this report has been obtained from sources that the firm believes to be reliable, we do not guarantee its accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the firm’s judgment as of the date of this report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security.