According to Murphy’s Law: “Anything can go wrong, will go wrong.” This encapsulates perhaps the most compelling reason for taking insurance.

According to Murphy’s Law: “Anything can go wrong, will go wrong.” This encapsulates perhaps the most compelling reason for taking insurance. By planning for the worst (and hoping for the best), insurance coverage can provide protection for your home and other assets, cover your healthcare costs and maintain your standard of living, thus ensuring stability for you and your family, and can give you peace of mind.

Sometimes we take the benefits of insurance for granted, perhaps partly because insurance has become so ingrained into our globalising society and is even legally mandated for certain types of activities by many jurisdictions. Captive insurance is the next step up for individuals or businesses, as it addresses insurance market volatility and accessibility to coverage that may not otherwise be feasible.

Although captive insurance is not for everyone, it can give the right wealthy clients greater control over insurance coverage, allowing the potential for cost savings and also granting a degree of asset protection not afforded through traditional self-insurance arrangements. Incorporating the captive insurance entity offshore adds a further layer of protection for clients focused on wealth preservation, which provides further peace of mind.

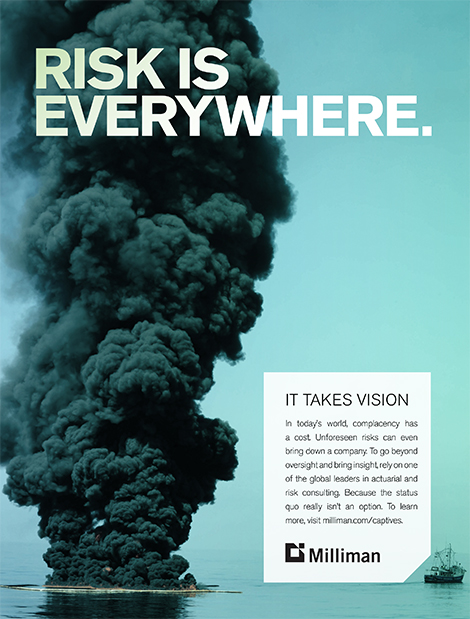

Era of uncertainty and risk

We now live in an era of increasing uncertainty. The effects of the post-9/11 war on terrorism has changed the way we live. The financial crisis jarred our faith in the banking industry with rippling effects internationally.

The perceived threats of global warming, increased pollution, and changing climate conditions continue to increase our concern around the world our children will inherit. Meanwhile, the global political scene is unsettling as international trade, migration, and transnational relationships are affected by changing political landscapes such as the UK’s exit from the EU, and divisive politics such as those seen in the recent US presidential elections.

Furthermore, with American protectionism and aggressive initiatives such as the anticipated EU blacklisting of non-EU international financial centres, the tides of uncertainty continue to surge. In contrast to this, we are also entering an age of unparalleled technology and tax transparency.

Technology has never been more advanced. We seem to now take for granted the ability to instantly video conference in real time with someone who is on the other side of the globe in a different time zone. Even seemingly remote locations on our globe have become accessible by our technology. Now we have even more technological marvels, from pocket translators to recreational and delivery drones to the remarkable potential of augmented reality, technology promises to make our lives more interesting, which undoubtedly will come with new insurable risk.

At the same time that technology enhances our personal lives, technology allows for unprecedented levels of international cooperation which can be seen in the efforts of the Organisation for Economic Co-operation and Development’s push for global tax transparency through the implementation of the automatic exchange of information for tax purposes (AEOI) programme. With the implementation of AEOI and the common reporting standard in more than 100 countries, national governments gain automatic access to information of its citizens’ offshore holdings which can then be considered within their respective tax regimes. However, any digital data collection of private wealth information is not without its associated cyber risk.

Establishing a captive that will last

Given the current global climate in which we live, it is no surprise that demand for cyber insurance, drone insurance, political risk insurance, stock market insurance, and alternatives to the seemingly doomed Obamacare has increased. Depending on your individual or business circumstances, establishing a captive insurance entity can be ideal to meet your insurance demands.

Known advantages to using a captive include: increased control over handling of insurance claims; flexibility in tailoring coverage to owner needs and providing coverage not otherwise available or cost-effective on the insurance market; reduced costs of risk management; stabilised pricing based on the owner’s loss experience, independent of commercial market volatility; ability to direct the investment of premiums and an opportunity to generate investment income; increased capacity to retain risk as the captive matures and surplus grows; and direct access to the reinsurance market, which may reduce costs and increase sources of risk transfer capacity.

There is also a potential for tax advantages, which should be considered in any decision to establish a captive but should not be the primary motivation behind captive formation. Obtaining professional tax advice is recommended before deciding to establish a captive.

Using a captive may also provide a degree of asset protection if established properly. Traditional self-insurance normally entails holding surplus funds to cover possible losses instead of purchasing a commercial insurance policy. If for some reason something goes terribly wrong with your business, the funds held for traditional self-insurance would still be reachable by your business creditors, unlike funds held in a properly formed captive.

Although maintaining a captive may require added expertise and administrative burden, such costs can be offset by contracting with a licensed captive insurance manager. It may also be important to ensure that key staff responsible for maintaining the captive have the required expertise to understand and utilise the advantages of captives over commercial insurance coverage; sometimes changes in such key staff could place the captive at risk if adequate expertise is not maintained.

The captive insurance market continues to grow, with estimates of over 90 percent of Fortune 500 companies already owning a captive. As uncertainty grows and international markets fluctuate, the option of forming a captive becomes more appealing. Understanding the advantages of forming a captive, it is important to ensure that a captive is established as part of a long-term business plan where proper feasibility studies are obtained.

The Cook Islands

In considering the formation or relocation of a captive, it is essential to look at the choice of domiciles or jurisdictions your captive may be established in.

Contrary to some belief, a jurisdiction with little or no regard for regulations may not be the ideal jurisdiction for those seeking to establish a captive that will last. The uncertainty of the times has led to a surge in international regulation and the Cook Islands’s ‘right-touch’ regulatory approach has done well internationally.

In 2009, the Cook Islands ranked in the top 20 percent of approximately 165 nations assessed for implementing international regulatory standards in an evaluation by the Asia Pacific Group (APG) on money laundering, a Financial Action Task Force-style regional body.

The next evaluation of the Cook Islands by the APG will be conducted this year and is expected to be positive. The Cook Islands has further received positive evaluations in both phase-one and phase-two peer reviews conducted by the Global Forum, which has led the Cook Islands to be well respected in the Pacific for its regulation.

The positive evaluations and robust implementation of international standards in the Cook Islands also led to the selection of the Cook Islands as the home of the Pacific Catastrophe Risk Insurance Facility (PCRIF) captive, a truly international effort by respected international organisations. The Cook Islands was selected over other jurisdictions for its established financial services industry and high regulatory standards.

As a disaster risk management programme, the PCRIF captive was established to serve the Pacific region and was only made possible through the efforts of the World Bank, Asian Development Bank, Pacific Islands Forum Secretariat, the Secretariat of the Pacific Community Applied Geosciences and Technology Division, the Global Facility for Disaster Reduction and Recovery, the government of Japan, and the EU.

The Cook Islands financial services industry has qualified professionals still working since the inception of the industry more than 30 years ago. The professionalism, experience, expertise, and global network of these professionals is an asset that speaks well of the Cook Islands. Having gained independence more than 50 years ago, five days before Singapore, the Cook Islands has enjoyed stability through its special relationship with New Zealand and diplomatic relations with over 40 other countries. Although some may consider the Cook Islands ‘remote’, its ideal location in the heart of the Pacific positions it in the ‘middle of everywhere’ during this highly technological era.

In a world of uncertainty, the Cook Islands stands as a bridge to financial security in establishing your captive.