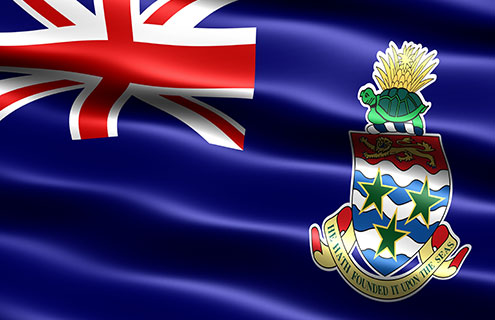

The Cayman Islands government is “deeply aggrieved” by the amendment to the UK’s Sanctions and Anti-Money Laundering Bill, according to a statement from the Cayman Islands Office of the Premier.

On 1 May, the House of Commons accepted an amendment to the Sanctions and Anti-Money Laundering Bill means the 14 British overseas territories will have to introduce public registers of beneficial ownership.

The amendment requires British overseas territories, but not Crown Dependencies, to establish the publish registers by the end of 2020.

In the event this does not happen, the UK will issue an order in council to force Cayman and other overseas territories to do so.

Cayman’s Premier, Alden McLaughlin, said the amendment was “based solely on prejudice and a wilful misunderstanding of our current regulatory framework” and “represents a gross affront” to the constitutional relationship between them.

McLaughlin added: “Since 2013 I have been completely clear that, when public registers become a global standard, the Cayman Islands will adopt them.”

“The actions in the House of Commons seeks to impose the UK’s own flawed system of unverified public registers upon the Overseas Territories by the end of 2020.”

“The actions of the House of Commons in seeking to legislate for the Cayman Islands amount to constitutional overreach and are reminiscent of the worst injustices of a bygone era of colonial despotism.”

The minister for financial services, Tara Rivers, said the action indicates the UK has chosen to ignore Cayman’s ongoing high level of cooperation.

She continued: “Over 100 tax authorities globally, including HMRC, and UK crime agencies already have access to information which states who owns what and how much in relation to Cayman companies.”

Erin Brosnihan, chair of Insurance Managers Association of Cayman (IMAC), said the association were fully supportive of the position take by the Cayman Islands Government and Cayman Finance on the issue.

Brosnihan added: “The Cayman Islands is a credible and transparent jurisdiction that has long had a verified register, maintained by regulated service providers, that is a far superior regime to what is being imposed by the UK’s amendments to the Sanctions and Anti-Money Laundering Bill.”

“The Cayman Islands has, for decades been working with international regulators to fight global problems such as tax evasion and corruption through the continual upgrading of our regulatory framework to abide by and in some cases exceed the global standards for regulation and transparency.”

She concluded: “We do wish to make it absolutely clear that Cayman demonstrates continued cooperation with international regulatory standards.”

“It is our goal, as a jurisdiction, to conduct the highest quality business, by providing high quality services to high quality business.”